schedule c tax form llc

Web A single-member LLC is a business entity owned by just one person. Web The Schedule C is an IRS form that collects data about your small business and then calculates your net profit.

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Income Tax Return for Estates and Trusts.

. Web Generally single member LLCs provide personal asset protection to their members for the liabilities of the business. The Schedule C tax form. Web The Schedule C tax form is part of IRS form 1040.

You can do this by checking with the Department of. Schedule C Form 1040 is a form attached to your personal tax. I need to know if this will affect their - Answered by a verified Tax Professional.

Confirm that the name you want for your LLC is available. Web Here are the steps to form an LLC in the State of New York. Answered by a verified.

Web I have a client who is selling their LLC sole member business for 2500000. Web Schedule C is a tax form for small business owners who are sole proprietors or single-member LLC owners. There is generally no distinction between the business owner and the LLC for income tax.

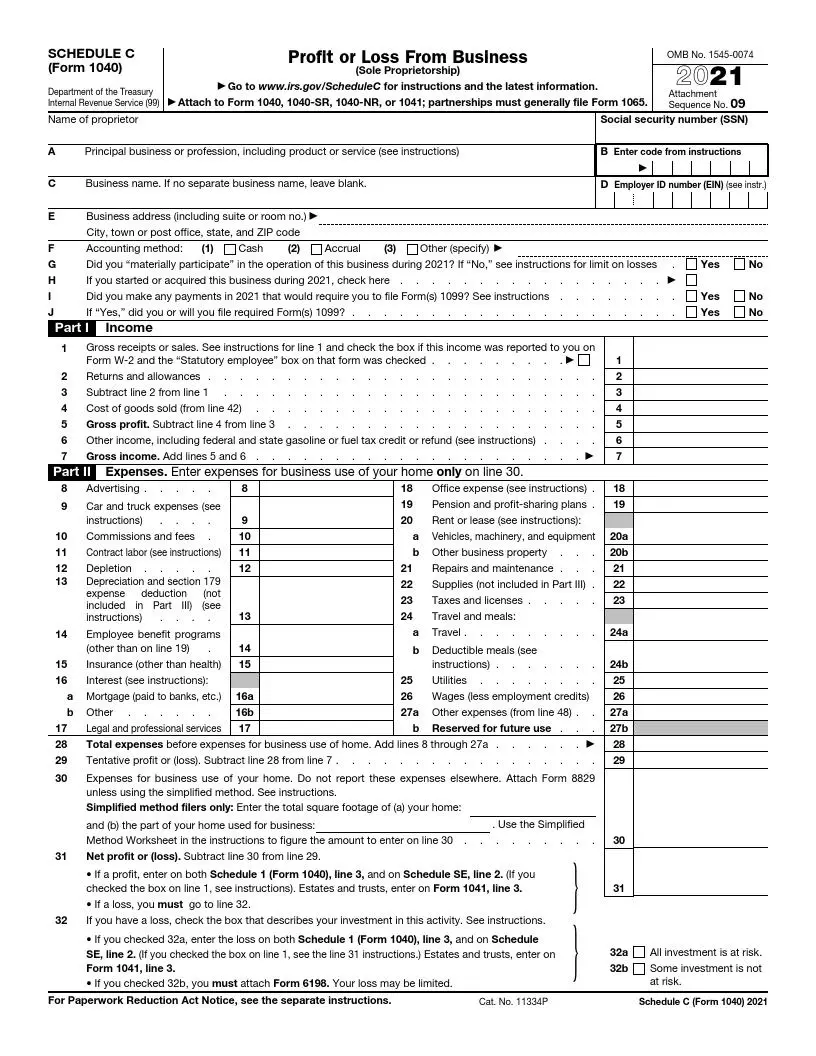

About Form 1041 US. Web Information about Schedule C Form 1040 Profit or Loss from Business. Web Schedule C is for two types of business a sole proprietor or a single-member LLC that hasnt elected to be taxed as a corporation.

The profit is the amount of money you made after. Web An LLC Schedule C should be used by a single-member LLC when filing business taxes as a sole proprietor. Sole proprietors must also use a Schedule C when filing taxes.

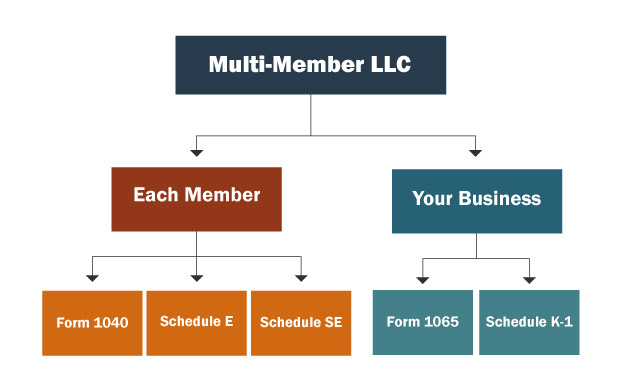

You have to fill and attach it or submit it electronically together with form 1040 when filing taxes. But they do not always provide the reverse. Web Then at tax time well file your business tax return whether it be Form 1120S for S-Corporations Form 1065 for Partnerships or Schedule C for single-member LLCs or.

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

Sole Proprietorship Taxes Understanding The Schedule C Tax Form Picnic Tax

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc How To Fill Out Form Schedule C Youtube

Memo Onlyfans Myystar Creators Business Set Up And Tax Filing Tips Chris Whalen Cpa

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Tax Forms Irs Forms Irs Tax Forms

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1040 Schedule C Form Fill Out Irs Schedule C Tax Form 2021

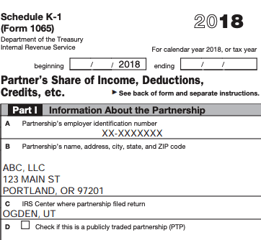

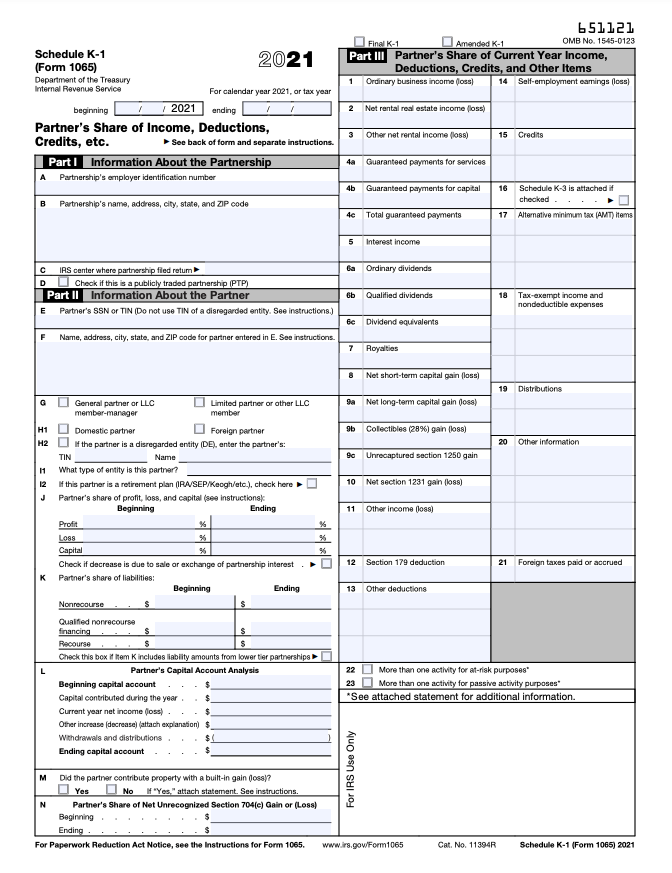

Schedule K 1 Tax Form For Partnerships What To Know To File Bench Accounting

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

1040 Statutory Employees Schedulec Schedulese W2

Schedule C Special Tax Treatment Schedulec

Schedule C Form 1040 How To Fill Out Schedule C Tax Form Ppp Loan And Schedule C Form 1040 Youtube

What Is Irs Form 1040 Overview And Instructions Bench Accounting

How To File Your Llc Taxes Truic

Federal Corporate Tax Preparation Preparing C Corp S Corp And Llc

What Do The Expense Entries On The Schedule C Mean Support

How To Fill Out Your Schedule C Perfectly With Examples